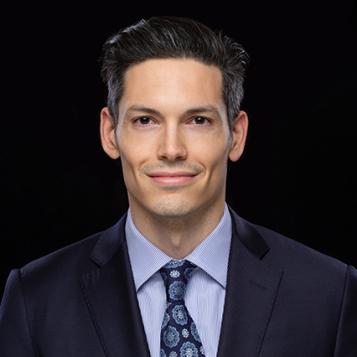

Serdar Inci

Serdar advises U.S. and international clients on the full spectrum of equity and debt capital markets transactions. On the equity side, he represents issuers, selling shareholders and underwriters in U.S. and cross-border IPOs, SPAC deals and private placements. On the debt side, he advises on SEC-registered and unregistered offerings of high-yield, investment-grade, and regulatory capital instruments, as well as liability management transactions.

His work spans the Nordics, Switzerland, Austria, Germany, the United Kingdom, United States, South Africa and India. He advises VC funds, family offices, listed and private multinationals, global financial institutions, and SPAC sponsors. Serdar’s sector experience includes biotech, healthcare, energy, fintech, consumer products, natural resources, infrastructure, industrials, automotive and sovereigns.

He is bilingual in German and English.

Experience

- IPOs by Centogene ($56 m IPO), EQT AB ($1.4 bn), Forbion European Acquisition Corp. ($110 m), IONOS Group (€447 m), Mountain & Co. I Acquisition Corp. ($230 m), and Target Global Acquisition I Corp. ($200 m)

- Other equity offerings by ACG Metals ($200 m private placement), Birkenstock ($845 m secondary & $200 m repurchase), Centogene ($49 m follow-on), Oncopeptides (SEK 1.1 bn private placement), SEAS NVE (DKK 5.4 bn secondary block sale in Ørsted), Viessmann (selling shareholder, $600 m secondary & repurchase), and Xspray Pharma (SEK 265 m private placement)

- Underwriters’ counsel on equity offerings by Bovis Homes (£152.2 m private placement), Haleon (three secondary offerings totaling $9.1 bn), Investcorp India Acquisition Corp. ($258.5 m IPO), and Levere Holdings Corp. ($250 m IPO)

- SEC registered or Rule 144A bond issuances by Aker BP ($1.5 bn), Anglo American (four offerings, total >$4 bn), AngloGold Ashanti ($750 m), British American Tobacco ($2.4 bn), Deutsche Bank (multiple offerings, total >$4 bn), Ferguson ($600 m), Kantar ($1.3 bn), NatWest Group (two offerings, total >$3 bn), Oesterreichische Kontrollbank (multiple offerings, total >$3.5 bn), Smith+Nephew ($1 bn), and subsidiaries of National Grid (KeySpan Gas East, Boston Gas, and Niagara Mohawk Power; $1.3 bn total)

- U.S. commercial paper programs for the RBS Group (now NatWest Group) ($5 bn) and Roche Holdings ($7.5 bn)

- Liability management transactions as dealer counsel on Aker BP ($1.1 bn cash tender), AngloGold Ashanti ($750 m cash tender), Holcim ($1.8 bn exchange offer), and NatWest Group plc ($1.9 bn cash tender)

Education

- Dr. Theo Waigel Scholarship

- Dr. Walter Oppenhoff Scholarship

- ERP Scholarship

- Senior Editor, Columbia Journal of European Law

- summa cum laude

- Studienstiftung Scholarship

- Editor-In-Chief, Cologne Business Law Review

- third in class

- Dean's Award for Academic Excellence

Qualifications and admissions

- State of New York

Not admitted in England & Wales