Commenters weigh in on SEC climate disclosures request for public input

The SEC’s request for public input on climate disclosures attracted 297 institutional comments totaling 3,290 pages. The views range from questioning the SEC’s authority to imploring the SEC to mandate comprehensive, internationally aligned and assured disclosures in SEC filings. This client update summarizes thirty comment letters we consider both important and representative of differing stakeholder views, in anticipation of a formal SEC proposal expected in or before October 2021.

Overview of the request for public input

The SEC took a first step toward the adoption of climate disclosure requirements by issuing a request for public input (the RFPI) on March 15, 2021. The RFPI requested comments from investors, registrants and other market participants “[i]n light of demand for climate change information and questions about whether current disclosures adequately inform investors.” To facilitate the SEC staff’s view of existing disclosure rules, the RFPI requested comment on fifteen questions, ranging from how the SEC could best regulate climate disclosures to whether the SEC should expand its focus from climate disclosures alone to a focus on environmental, social and governance (ESG) matters as part of a broader, comprehensive disclosure framework.

Comments on the RFPI were due June 13, 2021. The RFPI has attracted considerable attention and comments continue to be submitted well past the deadline. Commenters have written to the SEC to address the questions set out in the RFPI as well as a host of related topics. These comments include structural comments about the SEC’s authority and role; technical comments about what might be disclosed and how the SEC might work with standard setters and achieve international harmonization; legal comments about potential securities law liability considerations; comments about external and internal oversight of disclosures; and comments about whether the SEC’s forthcoming rulemaking should be limited to public issuers, as opposed to including private issuers, and should be limited to climate, as opposed to including the full suite of ESG topics. In some cases, the comments expressed highly divergent views. For example, some commenters opposed the SEC taking any action at all, while others stated that the need for SEC action is imperative.

The RFPI is part of a broader set of recent SEC climate and ESG developments, consolidated hereon the SEC’s website and as previously discussed by us in our March client update available here. These have included a directivefrom then-Acting Chair Lee to the Division of Corporation Finance to review and update the SEC’s 2010 guidance on climate disclosures,[1] an announcementby the Division of Examination that its 2021 examination priorities would include a greater focus on climate-related risks and the creationof an ESG Task Force in the Division of Enforcement. The RFPI is one important part of a broader SEC climate and ESG agenda, and we expect further developments in the coming months given the SEC’s rulemaking agenda and public statements made by Chair Gary Gensler suggesting a continued SEC focus in this area. Specifically, according to the SEC’s portion of the Spring 2021 Unified Regulatory Agenda, the following ESG and climate items are listed under the Proposed Rule Stage:

- Climate Change Disclosure, Notice of Proposed Rulemaking, by October 2021

- Corporate Board Diversity, Notice of Proposed Rulemaking, by October 2021

- Human Capital Management Disclosure, Notice of Proposed Rulemaking, by October 2021

- Investment Companies and Advisers ESG Matters, Notice of Proposed Rulemaking, by April 2022

As of June 24, 2021, 297 comment letters from institutional commenters filed by the June 13 deadline had been posted by the SEC on its website.[2] Together, these letters amount to 3,290 pages—a vast amount of information for the SEC to consider. In addition, a plethora of unaffiliated individuals submitted comments, and numerous individuals and entities, whose identities were not made available on the SEC’s website, submitted four form letter comments that together were submitted over 5,700 times.

In this client update, we summarize the key aspects of the non-form letters submitted by institutional commenters,[3] including a description of the types of commenters and, at a high level, the comments relating to six key topics raised in comments responding to the RFPI. The Appendix sets out the specific recommendations made in thirty institutional comments of potential high interest to our clients either because of their topical relevance (e.g., comments from trade organizations representing banking institutions) or because they are likely to garner attention or influence (e.g., comments from political figures). The full set of comment letters, including letters from unaffiliated individuals and form letters, can be found here.

Analysis of comment letters

Commenter type

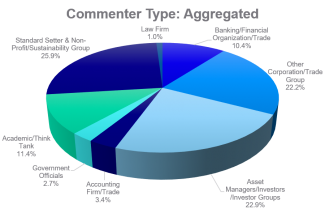

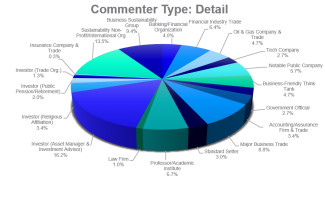

Comments were submitted by a wide variety of interested parties, from academics to political figures, individual companies to investors and trade organizations to environmental advocates. The distribution of all institutional non-form comment letters—that is, all letters other than letters from unaffiliated individuals and the over 5,700 form letters—by commenter type is illustrated in the pie charts below. The first chart presents a high-level breakdown of commenter type, while the second chart presents the same data at a more granular level.

Summary of key topics addressed in comments

Given the breadth of the issues raised by the comments, we focus in on six questions answered by commenters that we think are the most salient. These are:

- Does the SEC have authority to mandate climate disclosures, and would doing so survive the cost-benefit analysis required for rulemaking?

- Given a perceived desire for both meaningful and comparable climate disclosures, which types of disclosure standards (e.g., general or industry-specific standards, a single global standard or multiple standards around the world and a standard drawing on existing third-party frameworks or a novel framework) should the SEC use for any mandatory climate disclosure regime?

- If the SEC mandates climate disclosures, what information should the SEC require to be disclosed?

- Should the SEC provide protection from liability, whether through a safe harbor, having climate disclosures be furnished rather than filed or by requiring disclosures on a specialized form outside of 10‑Ks and 10-Qs?

- Should climate disclosures be subject to the same level of rigor as other types of SEC disclosures, such as financial disclosures, by imposing requirements for audit or assurance or internal controls?

- If the SEC creates a new disclosure mandate, should its scope include not only public companies but also private companies and not only climate disclosures but also ESG disclosures more broadly?

We discuss each of these areas in additional detail below, along with charts showing the distribution of the positions taken by commenters in these areas. Although the discussions are informed by the RFPI and comments broadly, the charts reflect only the thirty comments that we summarize in detail in the Appendix. For each chart, we present the distribution of these thirty commenters who supported, opposed or gave a mixed response on a particular topic within the six questions outlined above.[4]

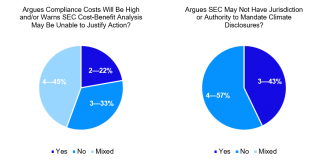

1. Does the SEC have jurisdiction and do benefits outweigh costs?

Some commenters emphasized that even if the SEC wishes to initiate a rulemaking to mandate climate disclosures, they believe that the SEC may not have the authority to do so. In our review of the comments, we observed several forms of this line of reasoning. Some argued that the SEC would need specific statutory authorization to mandate climate disclosures because its current rulemaking authority does not cover the disclosures at issue. Others argued that mandatory climate disclosures would be compelled speech in violation of the First Amendment. Still others highlighted the high compliance costs associated with climate disclosures, particularly for smaller registrants, and either stated or implied that an SEC mandate might not survive the cost-benefit analysis required for SEC rulemaking.[5]

In contrast, other commenters assumed the SEC would have the power to act or have made that argument explicitly. Commissioner Lee gave a speech in May 2021 to counter the “myth” that SEC disclosure rulemaking authority is limited to information that is material under the securities laws. Commissioner Lee argued that the SEC has broad rulemaking authority to require disclosures in the public interest, and that this authority is not limited by materiality.[6]

The following charts provide a graphical summary of the views on these questions among the set of thirty comments discussed in detail in the Appendix.

Does the SEC have jurisdiction and do benefits outweigh costs?*

* The pie charts include data for those of the thirty comment letters summarized in the Appendix that addressed the corresponding question. Because different comments focused on different topics raised in the RFPI, each pie chart reflects data for fewer than all thirty of the comment letters we summarize. A commenter’s response is designated as “mixed” if the comment both discussed the question and either provided some support and some opposition for the question or did not provide a clear directional view. Labels of “X—Y%” indicate the count of X responses followed by the Y% of the total in the chart they represent.

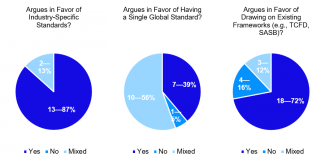

2. Which standards should the SEC adopt?

The RFPI raised multiple questions addressing which standards the SEC should use if it were to mandate climate disclosures. These included whether standards should vary by industry, how standards applicable to U.S. registrants should relate to other standards globally and how the SEC’s rules should draw upon frameworks already developed by standard-setting bodies.

Industry-specific standards present a potential trade-off between making climate disclosures meaningful and making them comparable. Some commenters expressed a strong desire for industry-specific standards, arguing that the climate aspects of various industries are sufficiently different such that industry-by-industry disclosures are necessary to meaningfully inform investors. Others stressed the importance of universal disclosures that apply to all registrants so that climate risks can be more easily compared across companies.

Aside from whether climate disclosure standards should be industry-specific or universal, commenters also opined on SEC coordination with global climate disclosure efforts. Many commenters encouraged the SEC to contribute to, and work through, international efforts to establish a harmonized global standard. This would promote consistency of disclosures across jurisdictions. Others stressed the need to act quickly or called attention to unique features of the U.S. securities law regime that would merit the SEC establishing its own standards, even if those standards differ from others around the globe.

On the related question of whether the SEC should leverage the work of existing climate standard-setting bodies, including international bodies, some commenters argued that the SEC should draw upon existing standards—such as those created by the Task Force for Climate-Related Financial Disclosures (TCFD) or the Sustainability Accounting Standards Board (SASB)—for international harmonization, among other reasons. Others argued against doing so, either because of substantive disagreement with those standards, procedural concerns about the governance and funding of those standard setters or both.

The following charts provide a graphical summary of the views on these questions among the set of thirty comments discussed in detail in the Appendix.

Which standards should the SEC adopt?*

* The pie charts include data for those of the thirty comment letters summarized in the Appendix that addressed the corresponding question. Because different comments focused on different topics raised in the RFPI, each pie chart reflects data for fewer than all thirty of the comment letters we summarize. A commenter’s response is designated as “mixed” if the comment both discussed the question and either provided some support and some opposition for the question or did not provide a clear directional view. Labels of “X—Y%” indicate the count of X responses followed by the Y% of the total in the chart they represent.

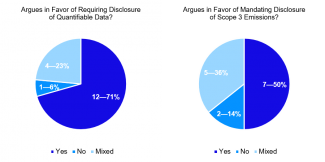

3. Qualitative vs. quantitative disclosures?

Beyond questions of whether the SEC should mandate climate disclosures and what standards it should use if it were to impose a disclosure mandate, the RFPI asked whether climate risk information can and should be quantified and disclosed, including, in particular, Scope 3 emissions. Unsurprisingly, commenters took opposing views.

Some commenters maintained that the SEC should require only qualitative climate disclosures, noting the difficulty of quantifying climate data, particularly Scope 3 emissions—those emissions that “are the result of activities from assets not owned or controlled by the reporting organization, but that the organization indirectly impacts in its value chain,”[7] such as the greenhouse gas emissions attributable to commercial real estate or motor vehicles that a bank finances. Others stressed that it is feasible and appropriate to require quantitative disclosures, which would allow for greater standardization and comparability across companies. These questions are intertwined with the question of whether disclosure standards should be industry specific, discussed above, or whether they should be tiered by company size or market capitalization, as quantification may be less burdensome for companies in certain industries as compared to others—for example, it is arguably easier for a large-cap technology company to measure and disclose accurately its Scope 3 emissions than it is for a small-cap financial institution whose customers are primarily private companies. As noted in their comments, some commenters already voluntarily disclose quantitative climate information, including Scope 3 emissions, which they cite as support that other registrants should be required to do the same.

The following charts provide a graphical summary of the views on these questions among the set of thirty comments discussed in detail in the Appendix.

Qualitative vs. quantitative disclosures?*

* The pie charts include data for those of the thirty comment letters summarized in the Appendix that addressed the corresponding question. Because different comments focused on different topics raised in the RFPI, each pie chart reflects data for fewer than all thirty of the comment letters we summarize. A commenter’s response is designated as “mixed” if the comment both discussed the question and either provided some support and some opposition for the question or did not provide a clear directional view. Labels of “X—Y%” indicate the count of X responses followed by the Y% of the total in the chart they represent.

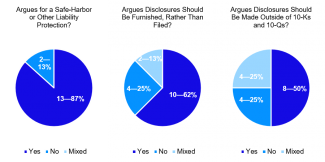

4. How should the SEC address potential liability?

A critical question for issuers is whether and, if so, how the SEC will “address the inevitable litigation risk that will come with such sweeping new disclosure requirements.”[8] In the comments on the RFPI, registrants and their trade organizations supported a number of different mechanisms to reduce potential liability. They argued that climate disclosures would present a heightened liability risk given the infancy of climate disclosures and unique features of climate disclosures, such as, for some registrants, necessary reliance on third parties to produce disclosures. Other commenters supported a robust liability regime as a means to enforce climate disclosure requirements and protect investors.

As evidenced by the comments, there are a number of forms that liability for climate disclosures could take. Although not addressed directly in the RFPI, some commenters recommended that the SEC provide a safe harbor from liability for climate disclosures, a position Commissioner Elad L. Roisman has also supported.[9] As part of the question of the form and provenance of liability, several commenters focused on where disclosures would be made and how they would be submitted to the SEC, topics on which the RFPI explicitly solicited comment. Some argued that climate disclosures should be furnished, rather than filed, to limit which securities law liability provisions would apply to the disclosures.[10] Similarly, some argued that disclosures should be provided on a separate, specialized disclosure form outside of 10-Ks and 10-Qs to limit potential application of certain liability provisions in the federal securities laws.

The following charts provide a graphical summary of the views on these questions among the set of thirty comments discussed in detail in the Appendix.

How should the SEC address potential liability?*

* The pie charts include data for those of the thirty comment letters summarized in the Appendix that addressed the corresponding question. Because different comments focused on different topics raised in the RFPI, each pie chart reflects data for fewer than all thirty of the comment letters we summarize. A commenter’s response is designated as “mixed” if the comment both discussed the question and either provided some support and some opposition for the question or did not provide a clear directional view. Labels of “X—Y%” indicate the count of X responses followed by the Y% of the total in the chart they represent.

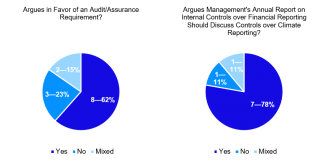

5. Audit or assurance of climate disclosures?

Several questions in the RFPI relate to measures the SEC might take to promote the reliability of climate disclosures, including measures similar to those used for SEC financial reporting. For example, the RFPI asked whether climate disclosures should be subject to audit or some other form of assurance and, if so, by whom. Another question asked whether management’s annual report on internal control over financial reporting should address controls over climate reporting and whether the CEO, CFO or other corporate officer should be required to certify climate disclosures.

Although some commenters were supportive of auditing or assurance, many others thought they would be a bridge too far.[11] Some of the opposition came from commenters who argued climate disclosures are not yet at the stage where it would be reasonable to apply the same degree of rigor as applicable to financial disclosures. Others appealed to more pragmatic reasons, citing insufficient expertise to conduct climate disclosure audits and explaining that the audit process for climate disclosures is currently so time consuming that disclosures would be stale by the time they were audited. Others—including third-party accounting and audit firms and some international investors—disagreed, highlighting the importance of having an audit or assurance process and explaining that, for some registrants, certain climate disclosures, such as GHG emissions, are already being assured.

The following charts provide a graphical summary of the views on these questions among the set of thirty comments discussed in detail in the Appendix.

Audit or assurance of climate disclosures?*

* The pie charts include data for those of the thirty comment letters summarized in the Appendix that addressed the corresponding question. Because different comments focused on different topics raised in the RFPI, each pie chart reflects data for fewer than all thirty of the comment letters we summarize. A commenter’s response is designated as “mixed” if the comment both discussed the question and either provided some support and some opposition for the question or did not provide a clear directional view. Labels of “X—Y%” indicate the count of X responses followed by the Y% of the total in the chart they represent.

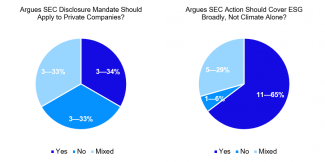

6. What should be the scope of any SEC action?

The RFPI raised important questions regarding to whom and over what subject matter any new SEC disclosure requirements might apply. Although much of the RFPI focused on the details of how to implement a climate disclosure regime, these big-picture scoping issues remain open questions.

With respect to scope of covered companies, the RFPI asked whether the SEC should subject private companies to a climate disclosure requirement. Some commenters, such as certain standard setters and investors, supported expanding the requirements to private companies, explaining that investors would benefit from climate disclosures from private companies just as they would from public companies. Some argued that failure to treat public and private companies similarly could result in regulatory arbitrage and could discourage private companies from going public, as well as create a different regulatory regime as compared to the one developing in Europe. In contrast, other commenters argued it would be unnecessary, or even inappropriate, for the SEC to impose a mandate on private issuers, citing reasons including the limited scope of impact of exempt offerings and jurisdictional grounds.

With respect to the scope of subject matter, the RFPI asked whether the SEC should address only climate disclosures at this time or should instead address climate disclosures as part of a broader ESG disclosure framework. Some commenters argued that climate is so important that the SEC should address it first, while acknowledging the importance of ESG matters more broadly. Others opposed mandatory ESG disclosures altogether. Still others supported including climate as part of a broader ESG disclosure package.

The following charts provide a graphical summary of the views on these questions among the set of thirty comments discussed in detail in the Appendix.

What should be the scope of any SEC action?*

* The pie charts include data for those of the thirty comment letters summarized in the Appendix that addressed the corresponding question. Because different comments focused on different topics raised in the RFPI, each pie chart reflects data for fewer than all thirty of the comment letters we summarize. A commenter’s response is designated as “mixed” if the comment both discussed the question and either provided some support and some opposition for the question or did not provide a clear directional view. Labels of “X—Y%” indicate the count of X responses followed by the Y% of the total in the chart they represent.

What’s next?

Although the SEC’s RFPI was exploratory and not an official proposal, it is widely expected that the SEC will proceed next to a notice of proposed rulemaking with the SEC’s initial answers to the questions above. As noted above, in the Spring 2021 Unified Agenda of Regulatory and Deregulatory Action published on June11, 2021, the SEC included that it intends to issue a notice of proposed rulemaking on climate disclosures in or before October 2021. This intention was crystalized in SEC Chair Gensler’s June 23, 2021 speech, in which he noted that he is “really struck by the call for enhanced disclosures” in comment letters responding to the RFPI. He stated that he has asked SEC staff to develop recommendations on mandatory climate disclosures, including evaluating a range of metrics and considering potential requirements for companies that make forward-looking climate commitments.

Separately, we understand from SEC staff that they are hard at work evaluating the comments on the RFPI. And although SEC staff met with dozens of stakeholders regarding the RFPI in the lead-up to the June 13, 2021 submission deadline, as the SEC has memorialized here, since the deadline the SEC staff have reported only one meeting.

All this points to an upcoming SEC proposal, which, like the RFPI, is sure to solicit a high volume of feedback from key stakeholders with diverse perspectives. Unlike the RFPI, any SEC notice-and-comment rulemaking would be subject to the requirements of the Administrative Procedure Act (APA),[12] and the SEC would be required to respond in a final rule to “materially cogent” comments.[13] The rulemaking process would therefore give the public a second bite at the apple beyond the RFPI, and one the SEC would have to address head on.

On the international front, global bodies focused on climate disclosures also continue to forge ahead. For example, on June 28, the board of the International Organizations of Securities Commissions (IOSCO) issued a report on sustainability-related issuer disclosures. The report, developed by IOSCO’s Sustainability Finance Taskforce, highlights the need to enhance consistency, comparability and reliability of sustainability reporting for investors, citing the recent June 5 G7 Finance Ministers and Central Bank Governors Communiqué to a similar effect. IOSCO’s report is supportive of the work of the International Financial Reporting Standards Foundation (IFRS Foundation) to establish an International Sustainability Standards Board (ISSB) for developing a climate reporting standard. The report notes that IOSCO has established a Technical Expert Group (TEG)—which is co-led by the SEC—to engage with the IFRS Foundation on the ISSB, and calls for creating standards leveraging the work of existing frameworks, including those of TCFD, the Global Reporting Initiative (GRI) and SASB, among others.

We will continue to monitor developments both domestically and internationally as the SEC evaluates public input and moves toward a proposal and, later, a final rule.

[1] See SEC, Commission Guidance Regarding Disclosures Related to Climate Change, 75 Fed. Reg. 6290 (Feb. 8, 2010).

[2] Comment letters are typically uploaded to the SEC’s website with a lag. We use the SEC’s June 13 comment deadline as a cutoff for the letters in scope for our analysis, but it is possible additional letters submitted prior to the deadline were uploaded subsequent to preparation of this client update. In addition, some comments were submitted subsequent to the June 13 deadline, and the SEC has been uploading these comments to its website, but these letters are not included in our analysis. As discussed further below, we also exclude from our analysis form letter comments that may have been submitted by either institutions or individuals.

[3] Neither the comments from individual commenters nor the form letter comments are included in our analysis.

[4] For any particular topic, commenters are excluded from the chart if they did not address the issue. We recorded a response as “mixed” if a commenter both discussed the topic and either provided some support and some opposition for the topic or did not provide a clear directional view.

[5] See 15 U.S.C. §§77b(b), 78c(f) (requiring, as part of any rulemaking under the Securities Act of 1933 and Securities Exchange Act of 1934, respectively, in which the SEC “is required to consider or determine whether an action is necessary or appropriate in the public interest,” that the SEC “also consider, in addition to the protection of investors, whether the action will promote efficiency, competition, and capital formation”); see also, e.g., Business Roundtable v. SEC, 647 F.3d 1144, 1148–49 (D.C. Cir. 2011) (vacating the SEC’s proxy access rule for failure to “adequately assess the economic effects of a new rule,” as required by Section 3(f) of the Securities Exchange Act of 1934 and Section 2(c) of the Investment Company Act of 1940, 15 U.S.C. §§78c(f), 80a-2(c), by, among other things “inconsistently and opportunistically fram[ing] the costs and benefits of the rule” and “fail[ing] to adequately quantify the certain costs or to explain why those costs could not be quantified”).

[6] For this proposition, Commissioner Lee cited to the SEC’s rulemaking authority under the Securities Act of 1933 and the Securities Exchange Act of 1934, 15 U.S.C. §§77g(a)(1), 78m(a), 78l(b), and 78o(d).

[7] U.S. Environmental Protection Agency (EPA), EPA Center for Corporate Climate Leadership, Scope 3 Inventory Guidance (May 18, 2021), available at https://www.epa.gov/climateleadership/scope-3-inventory-guidance. The EPA explains that Scope 3 emissions are often the majority of an organization’s greenhouse gas emissions, and the EPA distinguishes these from Scope 1 and Scope 2 emissions. See id. As defined by the EPA, “Scope 1 emissions are direct greenhouse (GHG) emissions that occur from sources that are controlled or owned by an organization (e.g., emissions associated with fuel combustion in boilers, furnaces, vehicles),” and “Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling.” EPA, EPA Center for Corporate Climate Leadership, Scope 1 and 2 Inventory Guidance (Dec. 14, 2020), available at https://www.epa.gov/climateleadership/scope-1-and-scope-2-inventory-guidance.

[8] Commissioner Elad L. Roisman, Putting the Electric Cart before the Horse: Addressing Inevitable Costs of a New ESG Disclosure Regime (June 3, 2021), available at https://www.sec.gov/news/speech/roisman-esg-2021-06-03.

[9] See id.

[10] The difference may appear to be one of semantics, but it is far from that. Unlike filings with the SEC, furnished reports are not subject to potential liability under Section 18 of the Securities Exchange Act of 1934. See 15 U.S.C. §78r. Moreover, certain standard filings, such as 10-Ks and 10-Qs, are routinely incorporated by reference in the securities offering documents of issuers, to which potential liability attaches under several provisions—including some strict liability provisions—of the Securities Act of 1933.

[11] This observation relates to the institutional comments at large, as our set of thirty comments discussed in detail in the Appendix—which includes several audit firms—may not be representative with respect to this question.

[12] See 5 U.S.C. §553.

[13] See, e.g., United States v. Nova Scotia Food Products Corp., 568 F.2d 240, 252 (2d Cir. 1977) (“Appellants additionally attack the ‘concise general statement’ required by APA, 5 U.S.C. §553, as inadequate. We think that, in the circumstances, it was less than adequate. It is not in keeping with the rational process to leave vital questions, raised by comments which are of cogent materiality, completely unanswered. The agencies certainly have a good deal of discretion in expressing the basis of a rule, but the agencies do not have quite the prerogative of obscurantism reserved to legislatures.”).

Appendix: summary of SEC climate RFPI comment letters

This Appendix summarizes thirty comment letters of potential high interest to our clients. These thirty are comments we believe are representative of the varying stakeholder views and which are likely relevant to our clients and/or are likely to garner attention or influence, as drawn from the following types of commenters: Academics, Accounting Firms, Asset Managers/Investors, Asset Manager/Investor Trade Associations, Banking/Financial Organization Trade Associations, Business Trade Associations, Government Officials, Standard Setters, Sustainability Groups and Technology Companies. A list of the commenters is below, followed by summaries.

Comments summarized

Academics

Accounting firms

Asset managers/investors

Asset manager/investor trade associations

Banking/financial organization trade associations

Business trade associations

Government officials

Standard setters

Sustainability groups

Technology companies

Academics

Professors Jill E. Fisch, Donna M. Nagy, Cynthia A. Williams and Other Securities Law Professors

- SEC’s Legal Authority: The SEC has broad authority to promulgate disclosure requirements, and ESG disclosure is within the SEC’s mandate.

- The SEC’s authority is not constrained by a requirement of materiality.

- The SEC has the legal authority to adopt private standards or develop original standards internally.

- Full text of comment letter

Accounting firms

Deloitte & Touche LLP

- Global Standard: Deloitte has worked closely with private sector efforts to develop high-quality standards, including the CDP (formerly the Carbon Disclosure Project), the Climate Disclosure Standards Board (CDSB), GRI, the International Integrated Reporting Council (IIRC), SASB and TCFD.

- Although these efforts have been helpful, they should be rationalized to achieve global convergence toward a single set of standards as a baseline. Local regulators, including the SEC, can adopt these standards and reflect jurisdiction-specific priorities as needed.

- Quality Disclosures: The SEC should prioritize incentivizing companies to produce high-quality disclosures.

- There is wide variation on where companies are in integrating ESG considerations into their activities. Even for well-intentioned companies, lack of preparation may greatly affect the quality of disclosures.

- The SEC should consider how new requirements fit within existing voluntary frameworks.

- Assurance and Controls: The SEC should evaluate how existing controls requirements and external assurance would apply to any new ESG disclosure requirements.

- The majority of S&P 100 companies already have their climate disclosures assured or verified by a third party, but the rigor of this review varies across companies.

- Safe Harbor: A safe harbor or other liability protection for ESG disclosures may be appropriate for forward-looking information or information containing significant estimates, and such protections would promote more robust and meaningful disclosure.

- Full text of comment letter

Ernst & Young LLP (EY)

- Global Standard: EY supports a global standard if possible.

- The SEC could either develop an independent standard or build off an existing standard.

- The SEC could consider the recent efforts of the World Economic Forum’s International Business Council (WEF-IBC) to identify a set of core quantitative and qualitative disclosures based on existing frameworks.

- Assurance: An assurance requirement could boost investor confidence.

- Assurance has long been a driving force behind high investor confidence in issuers’ financial reporting.

- The SEC should engage with the audit profession to determine the appropriate level of assurance for ESG disclosures.

- Full text of comment letter

KPMG LLP

- Global Standard: KPMG believes that global collaboration provides opportunities to ultimately reduce complexity and achieve greater consistency in ESG reporting.

- A codified effort under the umbrella of a single standard setter would achieve a faster and more consistent reporting baseline.

- The SEC is well positioned to participate in developing this global baseline through IOSCO. The SEC is co-leading IOSCO’s TEG, which is assessing recommendations as part of the IFRS Foundation’s efforts to develop global standards.

- Full text of comment letter

PriceWaterhouseCoopers LLP

- SEC Rulemaking Is Needed: Although Regulation S-K already requires disclosure of certain material climate information, rulemaking is needed to address investor interest in expanded and more consistent disclosures.

- Disclosures Should Address Climate Commitments: Disclosures should include the plans, assumptions and metrics set out by registrants to achieve the public climate commitments they have made, such as net zero carbon emissions commitments.

- Include Climate Disclosures in Annual Reports: The SEC should require climate disclosures to be included in Form 10-K to increase their quality and consistency.

- Liability Protection: Forward-looking statements and forecasts made on a reasonable basis and issued in good faith should receive legal liability protection, consistent with that of other financial forecasts.

- Phased Approach to Disclosures: A phased approach that potentially begins with large accelerated filers would provide investors with new information earlier while providing smaller filers time to prepare for implementation. However, disclosure requirements should be agnostic as to issuer class or size.

- Foundational Disclosure Requirements: The SEC should establish foundational disclosure requirements that apply to all registrants.

- Supplementary disclosure of industry-specific information could be developed in addition to, but not instead of, these foundational disclosures.

- The SEC should take into account the recommendations of the TCFD as it develops foundational disclosure requirements.

- Global Standard: Any rules adopted in the United States should be developed in coordination with a global standard setter, and the SEC should be actively engaged in influencing both the content and timeliness of developing global standards to ensure their comprehensiveness and suitability for the U.S. capital markets.

- The SEC could prepare initial rules to meet investor need for climate disclosures while also designating a local U.S. standard setter, which would allow cooperation with global standard setters while addressing U.S. investor needs and expectations.

- Independent Assurance: Audit firms provide independence, broad understanding of the companies they audit and other necessary factors to ensure investor confidence and enhance the credibility and reliability of climate disclosures.

- Audit reports on climate disclosures should be subject to the same Public Company Accounting Oversight Board (PCAOB) standards as financial disclosures, and the PCAOB should regulate audit firms or those who provide assurance services for climate disclosures.

- Internal Controls and Management Certification: Companies should develop appropriate controls and processes on climate disclosures, and those controls and processes should be subject to management’s certification.

- Focusing on Public vs. Private Company Disclosures: The SEC should focus on disclosures required by public companies.

- Focusing on Climate Disclosures: The SEC should prioritize its resources to address climate disclosures before focusing on broader ESG rulemaking.

- Full text of comment letter

Asset managers/investors

BlackRock, Inc.

- Global Standard with Industry-Specific Metrics: BlackRock supports moving to a single global standard that is aligned with the recommendations of the TCFD and has sector-specific metrics, such as those identified by the SASB.

- Quantitative Disclosures and Scope 3 Phase-In: At a minimum, the disclosure framework should provide investors with uniform reporting of quantitative measures, such as Scope 1 and Scope 2 GHG emissions, supplemented by additional information for industries and public issuers with more acute climate risk.

- The Commission should phase in Scope 3 emission data over time, providing a safe harbor where data and methodologies are still developing.

- Private Companies: Disclosure cannot be limited to the public markets but must also include private companies to be truly effective in building understanding of climate investment factors in the market and avoid regulatory arbitrage.

- Liability Protection: The SEC should provide a temporary safe harbor that, at a minimum, covers any quantitative disclosures as data and methodologies continue to develop.

- Full text of comment letter

T. Rowe Price

- Global Standard: T. Rowe Price acknowledges the need for a uniform global standard of ESG disclosures and supports the industry coalescing around the TCFD recommendations and SASB standards.

- The SEC should adopt a principles-based approach to facilitate disclosure of quantitative and qualitative information regarding climate risks and opportunities.

- The SEC should leverage a third-party standard setter.

- The SEC should establish an advisory committee to assist with evaluating existing work, using the SASB standards as a starting point.

- The SEC should actively lead and participate in international efforts around climate disclosures, including those through the IFRS Foundation, to achieve global harmonization. SEC domestic standards should not conflict with those created by the IFRS Foundation’s to-be-established ISSB.

- Quantitative Disclosures and Scope 3 Phase-In: At a minimum, the SEC’s disclosure framework should provide investors with uniform reporting of Scope 1 and Scope 2 greenhouse gas emissions.

- The SEC should require disclosure of Scope 3 emission data for issuers in industries for which these data are particularly material.

- For other industries, the SEC should phase in Scope 3 emission data once sufficient Scope 1 and Scope 2 data are being reported consistently and accurately.

- Private Companies: The SEC should consider requiring climate disclosures by private companies using the same threshold that applies to private company 10-K reporting.

- This would mitigate incentives to move high-carbon activity to private companies, which would perversely result in equal or GHG emissions with less transparency to investors.

- Liability Protection: The SEC should provide a temporary safe harbor for issuers reporting in good faith.

- Full text of comment letter

The Vanguard Group, Inc.

- Global Standard: Vanguard favors global standards aligned to well-established frameworks such as those set forth by the TCFD and the SASB.

- The SEC should work internationally to harmonize climate disclosures globally with existing voluntary frameworks.

- Quantitative Disclosures: Corporate disclosures should quantify the extent of a public company’s direct and certain indirect GHG emissions and make clear the implications for financial performance and enterprise value. At a minimum, the disclosure framework should provide investors with uniform reporting of Scope 1 and Scope 2 GHG emissions supplemented by additional information for industries and public issuers with more acute climate risk.

- For public companies with more acute climate risk, qualitative disclosure should be provided along with disclosures of governance, strategy analysis and risk management processes.

- Phase-In: Because of costs and liability concerns, the SEC should phase in climate disclosure requirements according to issuer market capitalization.

- Liability Protection: Issuers should have flexibility to make climate disclosures either in their 10-Ks, on their websites or through other voluntary means at their discretion, as a means of mitigating liability concerns for disclosures made in 10-Ks.

- Full text of comment letter

Asset manager/investor trade associations

Investment Company Institute (ICI)

- Global Standard: ICI supports a global framework to achieve consistency of requirements across jurisdictions.

- The SEC should play a leadership role in the sustainability work of IOSCO and IOSCO’s consideration of the IFRS Foundation’s proposed ISSB.

- The SEC should look to the European Union’s experience, as the European Union has moved ahead on many sustainability standards, recognizing that policy objectives may differ across jurisdictions.

- Private Companies: Climate disclosure requirements should apply to public companies and private companies that must provide periodic reports, or Rule 12g-1 reporting companies.

- The SEC should not impose climate disclosure requirements on funds and advisers as a means of addressing private companies and instead should require disclosures from private companies directly.

- Quantitative and Qualitative Disclosures: Issuers should disclose Scope 1 and Scope 2 GHG emissions, a narrative in line with the TCFD framework and their Form EEO-1 data (sustainability-related reporting).

- Materiality: Disclosures should be grounded in traditional materiality for both quantitative and qualitative information, as relevant ESG information is not always reflected in quantitative financial metrics.

- Liability Protection: Companies should not be mandated to provide climate information in Form 10-K and the SEC should allow other forms of disclosure, such as furnished on a Form 8-K, in a separate public report or on a company website. The SEC should encourage disclosure that is not boilerplate.

- Companies should still be subject to antifraud liability for materially misleading information.

- Assurance and Internal Control Requirements: At this time, the SEC should not mandate third-party assurance. Instead, the SEC should phase in assurance once the disclosure standards are stable, if the benefits exceed the costs. Until then, the SEC should require companies to develop and maintain internal controls for climate disclosures.

- Full text of comment letter

Banking/financial organization trade associations

American Bankers Association (ABA)

- Compliance Costs and Tailoring Requirements: The SEC’s implementation of climate change disclosure requirements should take into account compliance costs, especially for smaller organizations.

- To minimize costs, smaller organizations should have a longer transition period before being subject to an SEC disclosure mandate, and data disclosure requirements should be on a “comply or explain” basis. This would permit registrants to opt out of providing specific metrics if they provide a reasonable explanation for why this information cannot be obtained without unreasonable burden or expense.

- A flexible approach to disclosure will be needed, balancing different needs for different investors and from different-sized entities.

- Global Standard: The ABA supports efforts to create a global baseline but does not believe it is necessary to have one global standard setter.

- In the long term, the SEC should consider formally designating an ESG standard setter, much like it currently designates the Financial Accounting Standards Board (FASB) for financial accounting.

- In the short term, the SEC should take a flexible, principles-based approach.

- Quantitative Metrics: Before the SEC mandates disclosure of Scope 3 emissions, shortcomings related to the current lack of methodological consensuses and data, as well as the quality of such data, will need to be resolved.

- Because the existence of “tipping points” and the “non-linearity” of forecast modeling may put the usefulness of existing data into question, the SEC should start with narrow requirements focused on reliable (or expected to be reliable) data points.

- Liability Protection: To incentivize robust climate disclosures, the SEC should provide a wide safe harbor for climate disclosures and should provide the option for disclosures to be furnished.

- Safe harbors that limit liability for unintentionally misleading statements, amounts or estimates currently exist within the SEC’s reporting framework. Because current climate risk reporting systems are not yet adequately developed, the SEC should implement a safe harbor for climate disclosures.

- Registrants should have the option to furnish, not file, climate disclosures in a separate climate or sustainability report to be posted by the SEC on EDGAR or on the registrant’s website.

- Internal Controls: Furnished reports would not be subject to the same internal controls as traditional financial reporting.

- Full text of comment letter

Bank Policy Institute

- Flexible Disclosure Regime Focused on SEC’s Core Mission: Flexibility is critical as there is no clear investor consensus about which climate disclosures are considered the most relevant for investment decisions, in addition to current limitations around climate metrics and data.

- The SEC should focus its climate disclosure requirements such that they further the SEC’s core mission of protecting investors, maintaining fair, orderly and efficient markets and facilitating capital formation.

- Global Standards with National Adoption/Modification: The SEC should coordinate its approach with bodies developing international standards, and continue to actively engage in its role with IOSCO’s and the IFRS Foundation’s efforts to establish an international sustainability standard setter.

- The SEC should also coordinate its efforts on climate disclosures with other U.S. regulators, such as other federal banking agencies, to ensure there is no inconsistency or overlap in their efforts.

- Deliberative, Phased Process: A deliberative approach is necessary to ensure climate disclosures are useful and effective, and a phased process would provide the necessary time for registrants, especially those such as banking organizations that are dependent on external parties to gather data, to develop their ability to provide disclosures.

- Liability Protections: The SEC should limit liability through two paths: a safe harbor applicable to the SEC for forward-looking statements and explicit SEC guidance, rulemaking or other relief limiting potential liability for disclosures based on third-party information, which registrants can neither verify nor control.

- Climate disclosures will require some reliance on third-party-created data and information on climate, which would be beyond a registrants’ ability to verify and control. This reliance presents a unique challenge in the United States where registrants can be frequent targets of opportunistic private lawsuits.

- A separate, specialized Form Climate Disclosure (which could take the form of a Form CD) that is furnished rather than filed is justified by precedent (e.g., Form SD for the SEC’s Conflict Mineral Rule), consistent with existing principles for SEC disclosure and would help avoid potential liability.

- Audit or Assurance Requirement: Given the current cost of climate assurance and, should the SEC require disclosures in 10-Ks and 10-Qs, the difficulty of completing an audit or assurance process in advance of filing deadlines, the SEC should not adopt an audit or assurance requirement at this time.

- Full text of comment letter

Securities Industry and Financial Markets Association

- Quantitative Disclosures That Are Furnished: While material climate disclosures should be primarily principles-based, there are certain common key metrics that the SEC should require registrants to disclose. Metrics should be initially limited to those generally considered reliable, such as Scope 1 and Scope 2 GHG emissions.

- Metrics should be disclosed on a specialized climate disclosure form that is furnished as opposed to filed under the Regulation S-K disclosure framework. These metrics are not universally material and are time consuming to compile.

- Registrants should be permitted to provide these metrics on a “comply or explain” basis, which would allow them to opt out of disclosure if they can explain why they are doing so.

- Audit or Assurance Requirements: It would be premature to mandate audit or assurance requirements at this time. There should be a two-year period before revisiting this issue, which would provide time for professional service firms to develop capacity for auditing or assuring climate disclosures.

- Liability Protections: To encourage more registrants to disclose climate information, the SEC should provide safe harbor protections for both forward-looking (quantitative or qualitative) and historical (quantitative) climate information. The SEC should also take steps, such as issuing statements and guidance, to provide clarity on what is covered under the safe harbor protections.

- Global Coordination: The SEC should continue to be involved in ongoing international efforts to develop a globally consistent climate disclosure framework.

- Global coordination is critical to strengthen the quality, transparency and comparability of climate information, as well as to avoid a patchwork of standards that do not align or conflict with each other.

- However, the SEC should not make any commitments to an international standard until after the standard has been created and appropriately considered in the context of U.S. registrants and markets.

- Drawing on Existing Frameworks: The SEC should take into account the work of non-governmental standard setters (e.g., TCFD, CDSB) as it develops its climate disclosure framework, given that many jurisdictions and companies have already begun to conform to some of these standards, but should not adopt one of their standards at this time.

- Instead, the SEC should adopt a similar, or at least not inconsistent, framework. This will reduce compliance costs and increase registrants’ ability to attract capital from international investors.

- Minimizing Compliance Burdens: The SEC should be mindful of the compliance burden of climate disclosures. Some potential requirements, such as Scope 3 GHG emissions, would impose substantial burdens on, or be beyond the capacity of, some registrants.

- Such requirements would also have a disproportionate effect on smaller registrants and would merit a phase-in based on the size and complexity of the registrant.

- Phased-In Approach Both for Proposing and Implementing Disclosure Requirements: The SEC should take a phased approach both to proposing climate disclosure requirements and implementing them.

- A phased approach to proposing climate disclosure requirements would allow the SEC to evaluate the scope of disclosures over time.

- A phased approach for implementing climate disclosures would provide the needed time for the market to develop proper methodologies and ways to address climate data gaps.

- Focusing on Climate Disclosures: The SEC should prioritize its resources to address climate disclosures before focusing on other ESG disclosures.

- Full text of comment letter

Business trade associations

Business Roundtable

- Principles-Based Disclosures: Business Roundtable supports the SEC taking a principles-based approach to climate disclosures tied to traditional concepts of materiality, and encourages the SEC to recognize the important differences between U.S. and foreign markets.

- Drawing on Existing Frameworks: The SEC should consider permitting companies to satisfy climate disclosure requirements by complying with the guidance of a “recognized standard setter” (as defined by a new proposed SEC rule).

- This approach would allow companies to leverage work done to date and promote continuity and comparability of disclosures.

- Quantitative Disclosures: In addition to creating a principles-based disclosure framework, the SEC should require annual disclosure of Scope 1 and Scope 2 GHG emissions.

- Tailoring: Disclosure requirements should be tailored based on company size.

- Transition Period: The SEC should provide a transition period for complying with a climate disclosure mandate.

- Liability Protection: The SEC should allow disclosures to be furnished rather than filed and should provide a liability safe harbor for newly mandated metrics and data points and for forward-looking information.

- Full text of comment letter

Society for Corporate Governance

- Principles-Based Disclosures: The SEC should use its existing principles-based disclosure scheme rooted in materiality for climate disclosures.

- New disclosure requirements are not needed to ensure that companies provide reliable information on climate change risks.

- Existing enforcement mechanisms, including SEC enforcement actions and private litigation, provide robust means of ensuring protecting investors.

- Any new rules should be principles-based and grounded in materiality.

- Private Companies: Any new rules should not apply to private companies.

- Quantitative Disclosures: There are no metrics universally important to all companies or all investors.

- SEC Authority: The SEC has authority to mandate non-material climate disclosures but should not exercise that authority because of the high costs of such action.

- Liability Protection: Should the SEC mandate climate disclosures, they should be posted to registrants’ websites or furnished in a separate report, rather than be filed with the SEC.

- This would have the effect of limiting potential liability and clarifying that climate disclosures would not be subject to management’s report on internal controls over financial reporting or management certification.

- Audit or Assurance Requirement: The SEC should not require external assurance for climate disclosures, as an auditor’s responsibility does not extend beyond financial information identified in the auditor’s report. In addition, some information underpinning climate disclosures is often based on third-party information outside registrants’ control and therefore is not well-suited to assurance.

- Comply or Explain: Should the SEC mandate climate disclosures, the SEC should permit registrants to “disclose or explain,” which would allow them not to disclose and explain why.

- Standard Setter: The SEC should not delegate the creation of disclosure standards to a third party and instead should proceed, if at all, through notice-and-comment rulemaking under the APA. Should the SEC delegate to a third party, it should impose the same level of oversight the SEC uses for FASB and the PCAOB.

- Focusing on Climate Disclosures: The SEC should focus on climate disclosures and not expand to ESG, an area that is virtually limitless and rapidly evolving.

- Full text of comment letter

U.S. Chamber of Commerce

- Compliance Costs: New policies related to ESG should be made only after weighing the costs and benefits of the chosen course, with justification for new policies being made clear to affected parties and the public.

- The SEC should follow APA requirements when acting on climate and other future ESG rulemakings.

- Materiality: The SEC should not deviate from the long-standing U.S. materiality standard.

- Flexible Disclosure Regime: Under any new disclosure framework, the SEC should use a flexible disclosure regime designed to elicit decision-useful information on a company- and industry-specific basis.

- Liability Protection: To limit undue liability exposure, the SEC should permit climate disclosures to be furnished, rather than filed.

- There is no need to expose companies to greater liability exposure, as companies that voluntarily produce climate disclosures are already subject to potential liability for making materially misleading statements.

- To encourage robust disclosure, existing liability protections for forward-looking statements should equally apply to forward-looking ESG information.

- Standard Setter: The SEC should not delegate the creation of disclosure standards to an external party. Third-party standard setters may not be sufficiently independent of outside interests, and delegating to them would raise governance, due process and funding concerns.

- Audit or Assurance Requirement: The SEC should not mandate that climate disclosures be subject to third-party assurance and instead should allow a market-based approach to third-party assurance.

- Companies are in the best position to decide how to signal reliability to their investors.

- Full text of comment letter

Government officials

Republican Members of U.S. House Committee on Financial Services

- SEC Authority: The SEC’s increased focus on climate goes beyond its statutory mission. The existing U.S. materiality standard should already capture relevant climate information that should be disclosed in SEC filings.

- Standard Setter: The SEC should not outsource its responsibilities to a third-party standard setter.

- Third-party standard setters may have agendas outside of the interests of federal securities laws.

- Aligning climate and ESG disclosure standards with international standard setters would subject issuers to prescriptive metrics, will stifle innovation and would be at odds with the current U.S. disclosure framework focused on investor-oriented financial materiality.

- Regulation by Enforcement: The SEC appears to be attempting to regulate by enforcement, but any new requirements should be imposed through APA notice-and-comment rulemaking.

- Avoid Politicization: The SEC should focus on its core mission and not politicize itself by inserting itself into social and public policy debates, like over climate change.

- Full text of comment letter

Republican Members of U.S. Senate Committee on Banking, Housing, and Urban Affairs

- Disclosure Requirements Are Unnecessary: Extensive disclosures are already required under the federal securities laws, such as regarding a company’s business, properties, legal proceedings, risk factors and financial condition. To the extent climate change will have a material impact to these areas, it is already required to be disclosed.

- The push for more climate disclosures is unrelated to providing material information to investors and is part of an effort to impose progressive political views through the securities disclosure regime.

- Standard Setter and SEC Authority: Designating a third-party standard setter would be an unlawful delegation of regulatory authority, would avoid compliance with the APA and would contradict Chair Gensler’s commitment to robust cost-benefit analysis.

- Use of a third-party climate disclosure standard setter must be authorized by Congress, akin to congressional authorization for SEC recognition of an accounting standard setter.

- SEC’s Role: The SEC’s narrow focus is on financial markets, and federal securities regulations are not the appropriate vehicle to advance climate policy goals.

- Full text of comment letter

Senators Brian Schatz and Sheldon Whitehouse

- Incorporating Climate Risk into Audited Financial Statements: Climate risks have material financial impacts, such as the potential to cause sudden price shocks, and therefore climate risk management strategies should be incorporated into financial reporting and be evaluated by auditors.

- Financed Emissions Disclosure: Mandating financed emissions disclosure is necessary, because otherwise financial companies are incentivized to continue to engage with companies involved in the fossil fuel value chain, which in turn exposes those companies to substantial climate risks.

- Publicly traded financial firms should disclose Scope 1, Scope 2 and Scope 3 GHG emissions enabled by their investments and financing, as well as off-balance sheet activities (e.g., equity and debt underwriting, advisory work).

- Lobbying and Political Spending Disclosures: The SEC should require registrants to disclose all spending on political activities, as such contributions materially affect climate risks by misleading investors and undermining financial stability.

- Full text of comment letter

Senator Elizabeth Warren and Representative Sean Casten

- Financial Stability: Climate change may be the single largest systemic risk to our global financial system, and consistent and mandatory climate change disclosures are imperative.

- Climate Risk Disclosure Act of 2021: Senator Warren and Representative Casten have introduced in Congress the Climate Risk Disclosure Act, S. 1217/H.R. 2570, which presents a market-based solution to provide investors, lenders and insurers better climate information.

- The bill would require that climate disclosures address issuers’ evaluation of financial impacts and risk management strategies (including physical and transitional risk), governance structures and processes to identify and manage climate risks, actions being taken to address climate risk, resilience strategies for climate scenarios, and the role of climate risk mitigation in overall risk strategy.

- Full text of comment letter

West Virginia Attorney General Patrick Morrisey

- No Jurisdiction to Mandate ESG Disclosures: It would be unconstitutional under the First Amendment for the SEC to compel public companies to make disclosures regarding ESG matters.

- Federal securities regulations compelling speech must withstand strict scrutiny, and, as distinguished from efforts to protect investors from fraud and deceptive practices, there is not a compelling government interest in ESG disclosures.

- If the SEC proceeds down this path, these constitutional concerns will be raised in the rulemaking process and in court.

- Full text of comment letter

Standard setters

CDP North America, Inc. (CDP)

- Drawing on Existing Frameworks: The SEC should consider using the CDP disclosure system, which is an omnibus implementation platform, converges international efforts and includes government partnerships.

- The CDP disclosure system relies primarily on TCFD recommendations but also includes other existing frameworks and sees no disadvantage to using them.

- Quantitative Disclosures: The GHG protocol has globally accepted methodologies that are now fully integrated into the operations of any business that undertakes the measurement of its Scope 1, Scope 2 or Scope 3 emissions.

- The TCFD metrics include Scope 1, Scope 2 and Scope 3 GHG emissions, energy use statistics, energy efficiency targets, and emissions reduction targets.

- Scaling and Industry-Specific Standards: Climate disclosures can be scaled based on size and type of registrant, and CDP produces a scaled version of its disclosures system. In addition, CDP supports industry-focused standards, which can lead to more relevant and decision-useful information, and produces in its questionnaires sector-specific questions.

- Transition Period: CDP already exists and can be used by registrants for disclosures during a grace period, phase-in or pre-compliance stage.

- Private Companies: The CDP disclosure system receives information from both private and public companies and should be used as an example by the SEC.

- Audit or Assurance Requirement: CDP recognizes third-party assurance can increase the quality and reliability of data and should therefore be required.

- Management Certification: TCFD recommends disclosure of the role of upper-level management in assessing and managing climate risks and opportunities, and the CDP questionnaire captures this information.

- Comply or Explain: “Comply or explain” defeats the purpose of mandatory disclosures, which is to create regulatory certainty and establish a level playing field.

- Full text of comment letter

Principles for Responsible Investment (PRI)

- Support for SEC ESG Disclosure Mandate: PRI supports standardized, mandatory disclosure of ESG data and encourages the SEC to build a mandatory corporate reporting regime for ESG information that allows for consistent and comparable data to inform investment decisions.

- Full text of comment letter

Sustainability Accounting Standards Board (SASB)

- Industry-Specific Qualitative and Quantitative Disclosures: The SEC should require companies to make industry-specific qualitative and quantitative climate risk disclosures focused on financial materiality.

- Costs: In any cost-effectiveness analysis, the SEC should acknowledge the investment companies and investors have already made in reliance on the SASB standards.

- Focusing on ESG Disclosures: The SEC should ultimately address sustainability disclosures beyond climate alone, especially given strong investor interest in a range of sustainability factors, notably including human capital management.

- Third-Party Standard Setter: Legal precedent allows the SEC to rely on a third-party standard setter, but the SEC should still oversee the process to ensure strong governance, due process and transparency.

- The SASB standards are widely used and can provide a foundation for effective sustainability disclosure.

- Drawing on Existing Frameworks: Any SEC climate disclosure rulemaking should leverage the prototype disclosure standard co-developed by SASB, CDP, CDSB, GRI and the International Integrated Reporting Council (IRRC) in December 2020.

- Comply or Explain: Companies should be permitted to disclose on a “comply or explain” basis.

- Disclosure Outside of 10-Ks: The SEC should permit companies to satisfy a disclosure requirement by providing information in a widely disseminated manner—such as furnished on a Form 8-K, in a separate public report or on a company website—within a given time frame following the filing of the 10‑K.

- Liability Protection: The SEC should consider providing issuers a limited safe harbor from private plaintiff liability.

- Internal Controls: The SEC should consider requiring companies to describe internal controls over sustainability disclosures.

- Full text of comment letter

Sustainability groups

B Lab Global

- Quantitative Disclosures: Scope 1, Scope 2 and Scope 3 emissions should be included in climate disclosures given that they represent the climate impact of most businesses and are necessary to accurately understand a company’s performance and management of climate issues.

- Drawing on Existing Frameworks: Alignment to existing disclosure frameworks would provide benefits in terms of efficiency, would reduce reporting burdens for issuers who already disclose in alignment with those frameworks and would inform the SEC’s efforts through robust standards development processes that have already occurred.

- Materiality: The SEC should look more broadly than its traditional definition of financial materiality.

- The SEC should consider a double materiality standard, which would take into account not only the interests of shareholders but also those of other stakeholders.

- Focusing on ESG Disclosure Framework: Climate cannot be evaluated separately from other ESG issues.

- The SEC should set in place mechanisms to expand the content of required ESG disclosures over time and clarify that a climate-first approach does not imply climate impacts are the only issues to be reported and addressed.

- Full text of comment letter

Ceres and Group of 500+ Investors, Foundations, Companies, NGOs and Individuals

- Drawing on Existing Frameworks: The SEC’s work on climate disclosures should be based on the recommendations of TCFD.

- The TCFD recommendations have been endorsed by hundreds of companies and investors globally and are in wide use voluntarily.

- Quantitative Disclosures: Disclosure rules should include Scope 1, Scope 2 and Scope 3 GHG emissions, which are needed to assess the full range of climate risks facing companies.

- Industry-Specific Metrics: An SEC rulemaking on mandating climate disclosures should include industry-specific metrics, because material climate risks manifest in different ways by industry. These metrics should leverage existing standards already in common use.

- Filed, Not Furnished: Material climate disclosures should be filed in annual, quarterly and other appropriate SEC filings.

- Full text of comment letter

Friends of the Earth, Amazon Watch and Rainforest Action Network

- Industry-Specific Standards: The SEC should establish different reporting standards for different industries, as different sectors pose unique climate risks.

- Drawing on Existing Frameworks: The SEC should incorporate existing frameworks into its climate and ESG disclosure regimes. These frameworks created by third-party standard setters are useful and well researched.

- The SEC should not necessarily adopt an existing framework wholesale. Instead, the SEC should draw from the best components of each existing framework and combine them.

- Focusing on ESG Disclosure Framework: The SEC should require all public companies to disclose against a general standardized set of climate- and ESG-related metrics and qualitative descriptions.

- Private Companies: The SEC should require that all large companies, including private issuers such as large private companies owned by equity firms and hedge funds, and large offerings of securities be subject to the SEC’s public markets reporting regime.

- Registration exemptions could be conditioned on the issuer following the public company disclosure regime, including regarding financial information and climate and ESG requirements.

- Quantitative and Qualitative Disclosures: The SEC should require, at a minimum, that issuers disclose Scope 1, Scope 2 and Scope 3 GHG emissions. Issuers should also be required to disclose a qualitative discussion of risk management, business model and strategy under various climate scenarios.

- Filed, Not Furnished: The SEC should require issuers to include climate and ESG disclosures in annual and quarterly SEC filings and, where possible, integrate climate change disclosures into their audited financial statements.

- Management Certification: The SEC should require disclosures to be subject to review by the CFO and Audit Committee and subject to attestation by the CFO.

- Full text of comment letter

Natural Resources Defense Council

- SEC Authority and Need for Mandatory Disclosures: The SEC’s statutory authority to prescribe rules “necessary or appropriate in the public interest or for the protection of investors” allows the SEC to mandate climate disclosures, and that authority is not limited by whether the information to be disclosed is material.

- Without mandatory disclosures, markets may have blind spots on certain kinds of climate risk because voluntary disclosure frameworks do not result in disclosure of decision-useful information.

- Although some argue a disclosure mandate would be compelled speech in violation of the First Amendment, securities regulation generally falls outside the First Amendment. Even if the First Amendment were to apply, the disclosure mandate should be evaluated under a less demanding standard than strict scrutiny, which the mandate would satisfy.

- Quantitative and Qualitative Disclosures: The SEC should amend Regulations S-K and S-X to require public companies to file public disclosures regarding their GHG emissions, vulnerability to physical and transition climate risks, process for identifying climate risks and opportunities and corporate governance structure for sustainability.

- The SEC should require companies to disclose audited, tabular information about their Scope 1, Scope 2 and Scope 3 GHG emissions.

- Drawing on Existing Frameworks: Disclosures should be modeled on existing voluntary disclosure frameworks, including the standards set by the TCFD and the WEF.

- However, the SEC should review and consider endorsing future, updated standards.

- The SEC should continue to prioritize harmony between U.S. standards and international standards.

- Filed, Not Furnished: The SEC should require disclosures to be filed, not furnished. By not limiting liability through requiring filings rather than allowing disclosures to be furnished, the SEC will help ensure investor confidence in the accuracy and completeness of disclosures.

- Comply or Explain: The SEC should not adopt a “comply or explain” framework, as doing so would reduce the effectiveness of a disclosure mandate.

- Although a comply or explain framework would avoid potential challenges arguing the disclosure regime would impermissibly compel speech in violation of the First Amendment, such challenges should fail in any event, and the SEC should explore alternative ways to avoid First Amendment legal exposure.

- Nonetheless, the SEC could consider a comply or explain framework on First Amendment grounds, and, if it does so, it should apply that framework only to select disclosures that involve judgment and are not purely factual, such as scenario analysis disclosures.

- Private Companies: The SEC should adopt measures to expand its disclosure regime—including but not limited to climate disclosures—to private companies engaged in capital markets offerings. Specifically, the SEC should cap the size of exempt securities offerings at $100 million; condition registration exemptions on making certain public disclosures, including climate disclosures; revise its interpretation of shareholder of record so more companies are treated as public for disclosure purposes; and require large private funds to disclose their climate-related practices and holdings.

- Full text of comment letter

Sierra Club Foundation

- Standardized and Mandatory Disclosures: Standardized climate and ESG disclosures are needed to manage climate and ESG-related risks, opportunities and impacts, as well as to engage with issuers on their climate and ESG performance.

- Materiality: Disclosures should be focused on financially material risks, opportunities and impacts and incorporated into the financial reporting of issuers.

- Industry-Specific Standards: Issuers in carbon-intensive industries should be subject to more detailed reporting requirements.

- Focusing on ESG Disclosure Framework: Climate disclosures should be included in a broader ESG disclosure framework, to ensure consideration of social impacts in climate-related actions.

- Market-Wide Benefits to Offset Costs: While there will be costs incurred by mandating disclosures, significant benefits include improved understanding and pricing of climate and other ESG risks, as well as facilitating the transition to a climate-safe economy by better allocating investor capital to businesses aligned with international and national climate agreements and goals.

- Full text of comment letter

World Business Council for Development

- Filed, Not Furnished: Given sustainability and climate-related issues are not separate from financial ones, climate-related disclosures should appear in relevant parts of SEC filings, as well as in financial statements in accordance with existing financial standards.

- Adapt Existing Disclosure Rules: New, standalone disclosure rules would likely lead to fragmented reporting requirements and fail to build on existing disclosure principles.

- Drawing on Existing Frameworks: The SEC should consider aligning disclosure requirements to the TCFD recommendations, given their widespread support, and should align work with the IFRS Foundation and other regional efforts. The SEC should consider waiting to issue its rulemaking until a global ESG standard baseline is developed by institutions like the IFRS Foundation.

- The SEC should consider designating a domestic standard setter and, if it does so, have the standard setter work to align with FASB and other global standard setters and frameworks.