Dodd-Frank’s Seventh Anniversary

Friday marks the seventh anniversary of the Dodd-Frank Act. The outlook for financial regulation, and Dodd-Frank, has fundamentally shifted over the past year. Since President Trump’s election and his promise to “dismantle” Dodd-Frank, implementation of the 2010 law has been put into pause mode by all of the financial regulators except for the CFPB. At the same time, proposals for legislative and regulatory change are now part of the public discourse, but their likelihood of success remains uncertain and most changes will take many months to implement, especially in light of the slow pace of leadership change at the agencies. We are in an odd period of rulemaking stasis—perhaps the calm before the storm of a new regulatory environment.

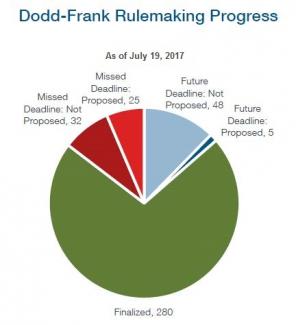

In this light, we feel that a usual Dodd-Frank Progress Report of the type we’ve published for the past seven years would be out of touch with current realities. Nonetheless, Dodd-Frank is still the law of the land and we know that many out there still follow its implementation. With that in mind, here is an update of the key rulemaking progress metrics we’ve followed for the past seven years, based on data from our Regulatory Tracker.

State of Play at the Seventh Anniversary[1]

- Of the 390 total rulemaking requirements, 280 (71.8%) have been met with finalized rules and rules have been proposed that would meet 30 (7.7%) more. Rules have not yet been proposed to meet 80 (20.5%) rulemaking requirements.

- Over the past year, 6 rulemaking requirements were met by previously proposed rules that were finalized.

- As of the seventh anniversary, 26,430 pages of Dodd-Frank-related rulemaking have been published in the Federal Register – 15,363 pages of final rule text and explanation, and 11,067 pages of proposed rule text and explanation. An average Federal Register page has approximately 1,010 words, so regulators have formally published more than 28 million words about Dodd-Frank-related rules.