FDIC Considers Amendments to Resolution Planning Requirements

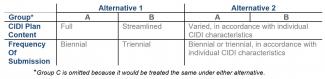

Yesterday, the FDIC issued and invited comments on a proposal to amend and restate their 165(d) Rule, issued jointly with the Federal Reserve, which implements the resolution planning requirements of Section 165(d) of the Dodd-Frank Wall Street Reform and Consumer Protection Act. This proposal is identical to the version issued by the Federal Reserve last Tuesday, April 8. The FDIC also issued and invited comments on an Advanced Notice of Proposed Rulemaking (ANPR) on its standalone IDI Rule requiring covered insured depository institutions (CIDIs) to submit resolution plans (CIDI Plans). The ANPR considers and invites comments on two alternatives for tiered resolution planning requirements based on CIDI size, complexity, funding structure and other factors; revisions to the frequency of submissions, changes to the process for engagement between the FDIC and CIDIs; and whether it should revise the $50 billion asset size threshold that makes institutions subject to the rule. Tiered CIDI Plan Requirements The ANPR uses three groupings to categorize CIDIs. Group A would include the largest, most complex, internationally active CIDIs. Group B would include larger, more complex regional CIDIs. Group C would include smaller, less complex regional CIDIs. It is not clear whether the tiers would be based strictly on asset thresholds or if the FDIC would also apply other quantitative or qualitative criteria. The FDIC also seeks comments on whether it should raise the $50 billion asset size threshold for CIDIs even though not mandated under the Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCPA), which raises the Section 165(d) resolution planning requirement asset threshold from $50 billion to $250 billion. CIDI Plan Content Under the first proposed alternative, a Group A CIDI would be subject to all content requirements specified in the amended IDI Rule. Group B CIDIs would be subject to a subset of those content requirements. Under the second alternative, content requirements for Group A and Group B CIDIs would vary in accordance with their size, complexity and other factors. Informational requirements for Group A and Group B CIDIs could be keyed off specific metrics related to, for example, off-balance sheet exposure, derivatives and trading activities or cross-border activities. Group C CIDIs would not be required to submit resolution plans under either alternative. The ANPR also describes streamlining of the IDI Rule’s content requirements that would be relevant regardless of which alternative is chosen. The FDIC states that it is reconsidering content requirements related to the corporate governance structure for developing, approving and filing resolution plans and, more interestingly, the requirement for CIDIs to develop their own resolution strategies. Frequency The FDIC is considering biennial or triennial CIDI Plan submissions, with the frequency to vary based on CIDI group or characteristics, depending on which alternative is chosen. Similar to the 165(d) proposal, the FDIC is also considering alternating between full and more streamlined submissions focusing on targeted areas. The ANPR invites comments on the relationship that the filing cycle should have with the 165(d) Rule resolution plan filing cycle, but does not express a view. The differences between the first and second alternatives are summarized below:

The ANPR also discusses what the FDIC calls “conditions-based supplemental resolution planning.” This could take place off-cycle when a CIDI begins to experience stress or becomes troubled, to ensure that the FDIC is prepared to resolve the CIDI. The ANPR contemplates triggers linked to ratings, liquidity measures, market indicators or other indicators that could prompt this supplemental resolution planning. Engagement and Capabilities Testing As discussed above, the FDIC is reconsidering the requirement for CIDIs to develop their own resolution strategies, and, as a consequence, the FDIC is considering modifying the IDI Rule to expand the process of CIDIs’ engagement with the FDIC to provide the FDIC feedback on the development of a resolution strategy for each CIDI. Engagement would likely focus on operation continuity, disposition of the CIDI’s franchise components, management information systems reporting capabilities and liquidity needs and liquidity management practices. Engagement with Group C CIDIs would cover a more narrow range of information, such as information on their core business lines, critical services and providers of those services and management information systems. The ANPR states that capabilities testing, as required under the current IDI rule, would also be tailored according to CIDI tier. * * * * The ANPR raises a number of questions for comment on each of these topics. You can find these questions here.

View as a PDF