FDIC Pledges to Jump Start the De Novo Bank Approval Process

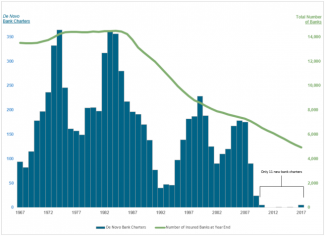

In the decade leading up to the 2008 financial crisis, de novo bank charters averaged more than 100 per year.[1] This robust flow of new bank charters continued a trend since the 1960s and before.[2] It partially offset a decline in the number of banks in the United States that resulted mainly from the consolidation of the U.S. banking industry. In contrast, only 11 new bank charters have been approved since the 2008 financial crisis. See Figure 1.

Figure 1. FDIC-Insured Commercial Banks Over the Last 50 Years

Data Source: Federal Deposit Insurance Corporation

Former FDIC Chairman Gruenberg and certain members of the Federal Reserve Board research staff have attributed this collapse in the flow of new bank charters to low demand—mainly as a result of historically low interest rates, net interest margins and bank profits and a generally challenging economic environment. Others have attributed it to the new regulatory burdens imposed by the Dodd-Frank Act or other factors.

But a number of critics have blamed the collapse on the FDIC’s deposit insurance approval process, which has been characterized as broken. For example, former Acting Comptroller Noreika said that the FDIC “just let it hang out there forever, so that the organizers [of proposed new banks] wasted all their money trying to get insurance, and then they gave up.” Indeed, recent demand for nonbank charters by fintech companies to engage in peer-to-peer lending, payments processing, blockchain-based money creation and other core aspects of the banking business undermines the assertion that the collapse in the flow of new bank charters resulted from a lack of demand rather than inefficiencies in the deposit insurance approval process or inflexibility in the bank regulatory framework, or both. Moreover, to the extent that the FDIC was concerned about the relatively high percentage of de novo banks that failed in the financial crisis,[3] the post-crisis reforms to strengthen capital requirements and the improvement in economic conditions should have made any such reluctance to approve deposit insurance applications for proposed new banks at most a temporary measure.

During her confirmation hearings, FDIC Chairman Jelena McWilliams promised to reform the FDIC’s deposit insurance approval process. Last week, she announced her initial reforms, which consist of various changes to the FDIC’s deposit insurance application manuals,[4] a new confidential review process for draft applications and a public Request for Information. She simultaneously published an op-ed in the American Banker, stating that “a pipeline of new banks is critical to the long-term health of the industry and communities across the country. The application process should not be overly burdensome and should not deter prospective banks from applying.” She also lamented the drought in new bank formations in the last decade, highlighting that “prior to the financial crisis, the only time since the FDIC was established in 1933 that fewer than 20 new, insured banks opened in a single year was 1942, in the midst of World War II” (emphasis added).

The thrust of the FDIC’s de novo initiative, therefore, is to encourage new bank formation by reducing the burden of the deposit insurance application process for prospective bank organizers. We discuss the initial reforms in more detail below.

Review Process for Draft Applications

The FDIC has established a new procedure through which new bank organizers can request feedback on their draft deposit insurance applications before filing the official application, giving organizers an opportunity to address issues in applications on a confidential basis before filing a formal application. Organizers would submit a draft deposit insurance proposal, accompanied by a draft application, for which the FDIC would expect to provide interim and overall feedback within 30 and 60 days, respectively. The opt-in draft review process is an upgrade to the already important pre-filing meeting step because addressing key issues at the pre-filing stage is critical to an efficient application process.

Updated Application Manuals

The FDIC also updated two documents related to deposit insurance applications: Applying for Deposit Insurance – A Handbook for Organizers of De Novo Institutions, and Deposit Insurance Applications Procedures Manual. The updates reflect streamlined timeframes for several steps of the application process, replacing ranges of time for the completion of certain application steps with a single fixed time period, at the lowest end of the previous range. For example, where the FDIC previously estimated it would act on all deposit insurance applications within 120 to 180 days, it will now strive to do so within 120 days total. The FDIC also added language to the Deposit Insurance Applications Procedures Manual that explicitly keeps the 120-day clock running while applicants respond to FDIC requests for additional information, thereby rejecting the practice of restarting the clock when additional information is requested. The updated timeframes are reflected in the FDIC’s Processing Timeframe Guidelines for Applications, which it reissued in conjunction with its other releases. Updates to the documents also implement the new voluntary procedure to submit and receive feedback on draft deposit insurance proposals.

Request for Information

The FDIC also issued a Request for Information in connection with the announcement of its de novo initiative. The request solicits comments on a number of topics related to the improvement of the application process, including the ways in which the FDIC could or should support the evolution of emerging technology and fintech firms. Comments are due 60 days from the date of publication in the Federal Register, which has not yet occurred but is expected shortly. We expect strong support for Chairman McWilliams’s goal of reducing the hurdles to de novo bank formation, with comments from the industry on additional specific ways of doing so.

Observations

While the reforms announced by the FDIC are a step in the right direction, the proof of the pudding will be in how the FDIC actually implements them. True change will require the agency from top to bottom to internalize the FDIC Chairman’s conviction that a pipeline of de novo bank charters is in the public interest and to act to facilitate, rather than inhibit, the creation of de novo banks. It will also require the FDIC Chairman and Board to hold the application staff accountable for implementing the deposit insurance approval process in an efficient manner. Without the agency’s commitment and accountability, the FDIC deposit insurance approval process could continue to be what some critics have described as death by a thousand cuts. We are hopeful, however, that the FDIC’s proposed reforms in writing will be matched by genuine reforms in practice.

[1] See FDIC, “De Novo Banks: Economic Trends and Supervisory Framework,” Supervisory Insights (Summer 2016) (link).

[2] See Preston Ash, Christoffer Koch and Thomas F. Siems, “Too Small to Succeed?—Banks in a New Regulatory Environment,” Financial Insights (Fed. Reserve Bank of Dallas, Dec. 31, 2015) (link) and Michael Barr, Howell Jackson and Margaret Tahyar, Financial Regulation Law and Policy 167 (2d ed. 2018) (“For many years after the Great Depression, the number of bank charter additions … roughly equaled the number of bank charter disappearances….”).

[3] See supra note 1 (“the failure rate of banks established between 2000 and 2008 was more than twice that of small established banks”).

[4] See blacklined versions of those documents reflecting the changes made (blacklined Handbook for Organizers of De Novo Institutions and blacklined Deposit Insurance Applications Procedures Manual).