Federal Reserve Proposes Amendments to 165(d) Resolution Plan Rule

Today, the Federal Reserve issued and invited comments on a proposal to amend and restate their 165(d) Rule, which implements the resolution planning requirements of Section 165(d) of the Dodd-Frank Wall Street Reform and Consumer Protection Act. The Notice of Proposed Rulemaking for this new 165(d) Proposal is available here, and the memorandum prepared by the staff of the Federal Reserve is available here. The questions that the Federal Reserve raised in the 165(d) Proposal for comment, a detailed TOC of the 165(d) Proposal, and a separate release containing visuals showing the applicability of the 165(d) Proposal to foreign and domestic filers and summarizing the differences between full and targeted resolution plans under the 165(d) Proposal is available here. The FDIC is scheduled to approve a substantially identical 165(d) Proposal next Tuesday, April 16. The FDIC’s proposal for its solo insured depository institution rule will be voted on at the same time. How that would interact with the 165(d) Proposal is unknown. We expect, however, that there will be more alignment than under the current regulations. The 165(d) Proposal would completely remove from the 165(d) Rule requirements domestic firms with less than $100 billion of total consolidated assets and foreign firms with less than $250 billion of total global consolidated assets. Application of the 165(d) Rule to larger firms would be tailored in a manner that is designed to be consistent with the requirements of the Economic Growth, Regulatory Relief, and Consumer Protection Act. If adopted, the 165(d) Proposal would be effective on the earlier of the first day of the first calendar quarter after the issuance of the final rule and November 24, 2019—in other words, before what would otherwise be the year-end filing date for certain firms. Key changes in the 165(d) Proposal include:

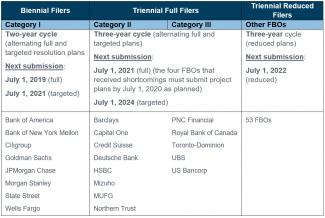

- tailoring resolution plan content requirements and submission cadences (biennial for the U.S. G-SIBs, triennial full and triennial reduced for other filers) based on asset size and complexity of operations, as shown in Figure 1 below;

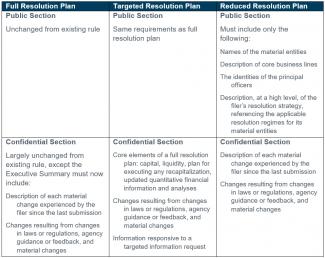

- establishing resolution plan content requirements for full, targeted and reduced resolution plans, as shown in Figure 2 below, and

- updating certain procedural elements of the 165(d) Rule, including by:

- allowing filers to apply for a waiver of certain informational content requirements of a full resolution plan;

- establishing processes for identification of critical operations and for firms to seek to rescind prior critical operations identifications made by the Federal Reserve and FDIC;

- defining the meaning of “material” for purposes of describing material changes since the filing of the filer’s previously submitted resolution plan;[1]

- revising the requirement to provide the Federal Reserve and FDIC notice of material events to make it clear that it applies only to “extraordinary events,” defined as “a material merger, acquisition of assets or other similar transaction, or a fundamental change to a covered company’s resolution strategy (such as a change from single point of entry to multiple point of entry)”; and

- formalizing definitions for “deficiency” and “shortcoming.”

The 165(d) Proposal also seeks comments on an alternative approach for dividing U.S. and foreign filers into groups for the purposes of determining the resolution plan content requirements and submission cadences. This alternative approach would be derived from the scoring methodology used by the Federal Reserve to calculate a U.S. G-SIB’s capital surcharge, described here. [1] This usage of material is different from the usage of the same term in the current rule and it is used for a different purpose. Figure 1: Resolution Plan Content Requirements and Submission Cadences Based on Filer Asset Size and Complexity

Figure 2: Resolution Plan Content Requirements for Full, Targeted and Reduced Resolution Plans