UK Takeovers: Recap of key developments and trends in 2024

With changes to the scope of the Takeover Code taking effect today, this update recaps Takeover Code developments and key trends in UK takeover activity over the last 12 months.

Takeover Code: key developments

- Narrowed scope of companies to which the Takeover Code applies. With effect from February 3, 2025, the Takeover Code will apply a new jurisdictional framework that narrows the scope of the companies to which the Takeover Code applies. Notably, at the end of a two-year transitional period, the Takeover Code will no longer apply to UK incorporated companies that are only listed on NYSE or NASDAQ. Our article for Law360 on the impact of the changes for companies can be found here and our client update on the topic can be found here.

- Guidance on private sales processes. On April 30, 2024, the Panel published amendments to Practice Statement 31 (sales processes and strategic reviews) recognizing that a company may run different types of sales processes – including a formal sales process (FSP), a private sales process, a strategic review and a public search for potential offerors – and providing new guidance in respect of the application of the Takeover Code to private sale processes. Our client update on the topic can be found here.

- Guidance on target representative directors and bidder intention statements. The Panel published two bulletins in 2024 to remind practitioners and market participants of the operation of specific provisions of the Takeover Code. The new bulletins covered equality of information and the position of shareholder representative directors sitting on the board of a target (Bulletin #6 published in January 2024) and the formulation and disclosure by a bidder of its intention statements relating to the target and its business (Bulletin #7 published in May 2024). Our client update on the 2024 bulletins can be found here.

- CLLS model terms and conditions for an offer. The City of London Law Society (the CLLS) have prepared (and periodically update) a model set of terms and conditions for an offer. On March 4, 2024, the CLLS published a revised version of its “Conditions to and Certain Further Terms of the Offer” dated February 1, 2024. The revisions to the CLLS model terms and conditions follow the Panel’s revisions to Practice Statement 5 (invoking conditions and pre-conditions) to reflect its approach to the interpretation and invocation of conditions to an offer. Our client update on the new terms can be found here.

- Rare use of “cold shoulder” sanction and first compensation order. In July 2024 the Panel published an executive statement, following a decision of the Takeover Appeal Board, concluding a multi-year investigation and disciplinary action relating to serious breaches of the Takeover Code that had taken place in relation to MWB Group, resulting in a breach of Rule 9 of the Takeover Code and provisions of the Introduction to the Takeover Code (the requirements to take all reasonable care not to provide incorrect, incomplete or misleading information to the Panel and to consult the Panel when in doubt as to whether action is in accordance with the Takeover Code). The former resulted in a compensation order being made in favour of affected shareholders of up to £32.5 million, the first compensation order made under powers given to the Panel by section 954 of the Companies Act, and the latter resulted in a number of individuals involved being “cold-shouldered” (effectively prevented from advising on any Takeover Code transactions) for misleading the Panel in the investigation that followed the breach.

Takeover offers for Main Market listed and AIM traded targets: key trends

- A similar number of offers, but at a much higher aggregate value. There were 56 firm offers for Main Market listed and AIM traded targets in 2024 (57 in 2023) with a total value of over £50 bn (£19 bn in 2023) and an average value per firm offer of around £1 bn (£300 m in 2023). The number of firm offers announced throughout the year was relatively constant, with increased activity in the spring and towards the end of the year (8 firm offers were announced in December alone) as PE bidders returned to the market.

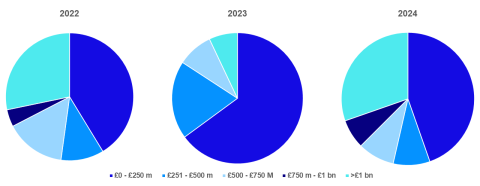

- The return of the £1 bn deal. There were significantly more firm offers over £1 bn (30% of all firm offers) when compared to 2023 (7% of all firm offers) and an average deal size nearly three times higher than in 2023. This is in stark contrast to last year when takeover activity was firmly focused on the small-to-mid cap segment (as indicated by the bright blue segment – representing offer values of up to £250 m – in the charts below).

More strategic bidders, fewer PE bidders. Strategic bidders returned to the market in 2024, with 50% of all firm offers being made by public companies – up from 25% in 2023. On the other hand, PE backed bids were down on 2023 by 20%, making up 43% of firm offers.

Shareholder pressure to pursue synergistic inorganic growth, the possibility of acquiring quality assets trading at a structural undervalue (particularly relative to the US), the ability to bridge valuation mismatches more easily with share consideration and a relative insensitivity (compared to PE bidders) to the cost of debt, likely contributed to the increased proportion of strategic bidders.

Although expectations at the start of 2024 that interest rates would fall faster and PE bidders would again constitute the majority of bidders did not materialize, PE sponsors were more willing to make (or invest alongside strategics who were making) offers for more expensive targets with £1 bn plus valuations (8 of the 17 bids above £1 bn).

It wasn’t all in-bound: UK bidders were also active. Like prior years, bidders were incorporated in a variety of jurisdictions. UK incorporated bidders (shown in bright blue in the charts below) were, however, the most active, making 22 of the 56 firm offers. This looks largely to be a consequence of the recent consolidation in the UK REIT / real estate market.

Predictions that a strong dollar and enhanced regulatory scrutiny at home would encourage US bidders (both strategic and PE) to seek expansion abroad look to have been broadly correct. US bidders (shown in light blue in the charts below) made the second highest number of firm offers (15 firm offers) in 2024, with a total spend of £18.6 bn and an average value per offer of £1.2 bn.

- Irrevocables from target shareholders remained popular. Irrevocable undertakings to support an offer were a feature of most deals, with an expectation from bidders of “hard” undertakings from director shareholders and “hard” or more likely “semi-hard” undertakings from non-director shareholders, with termination triggered by changes in deal terms or a competing offer at an agreed level above the recommended offer. In some cases, the irrevocables were given over <1% of issued share capital (usually where directors held nominal shareholdings) and at the other end of the range some deals saw irrevocables given over around 70% of issued capital, with most being between around 15% and 40% of issued capital in aggregate.

- Target shareholders were vocal (but not always successful) on value. Target shareholders (including shareholders who are not traditionally considered as “activist”) were increasingly active in making their views against an offer or possible offer publicly known. Although they are not new tools for a bidder, switching from a scheme to a contractual offer with a low acceptance condition, and publishing take it or leave it “no-increase” statements in respect of their offer price, were used effectively by bidders in response. The number of public price increases following the announcement of a recommended firm offer remained stable at 9% of all firm offers in 2024 (9% in 2023).

- Schemes remained universally popular. As seen in prior years, the scheme of arrangement (which provides greater certainty of acquiring 100% of the target) remained the acquisition structure of choice for a recommended bid. In 2024, 95% of firm offers were structured as a scheme of arrangement (rather than a contractual offer), including two cases where a later competing bidder switched its offer to a scheme following receipt of the recommendation from the target’s board.

An increase in the popularity of share consideration. The number of cash only bids declined from 77% in 2023 to 62% in 2024 and, conversely, the proportion of offers involving shares increased (with full share, partial share and share alternative offers all being made). The number of deals involving listed stock consideration was the highest for several years.

The cost of debt to fund cash deals remained relatively high in 2024, and PE and private company bidders showed a greater willingness than before to offer an unlisted “stub equity” alternative to secure the deal (particularly where non-institutional or management shareholders held large stakes in the target’s register). The number of public company bidders more naturally able to offer share consideration also accounted for a greater proportion of firm offers.

Notwithstanding significant changes to the UK listing regime over recent years, absent a more fundamental policy change (for example, tax incentives or pension reform) from the UK government in 2025, outflows from UK equity funds are thought likely to continue and UK equities may continue to be considered structurally undervalued (and bids for them perceived as opportunistic by target shareholders). If target shareholders adopt a longer-term view of fair value, bidders may continue using shares and share alternatives in 2025 as a way of bridging the valuation gap (particularly where there are large non-institutional shareholders on the register), even if financing costs decrease.

- Common for deals to involve some form of debt financing. 48% of firm offers in 2024 involved some form of debt financing. Where cash consideration was not debt financed, it was funded from existing cash resources (usually strategic bidders), an equity subscription (usually PE bidders) and, in at least a couple of deals, from the proceeds of a public capital raising.

Tailored regulatory conditions were common. Market practice remained to include conditions precedent to allow for completion of informal CMA briefing paper engagement and NSI mandatory notifications. In deals where no proactive engagement is envisioned, springing conditions precedent to cover off the risk of call-in and interim orders by the CMA and the ISU remain important.

In connection with regulatory conditionality, 2024 saw two bidders agree to provide reverse break fees in the event regulatory conditions were not satisfied by the long-stop date or were invoked (no such break fees were given in 2023). Anecdotally, targets were also more focused on extracting a higher level of endeavors undertaking to secure regulatory clearances from bidders in co-operation agreements.

- Continued active enforcement of UK National Security and Investment (NSI) Act. While the Investment Security Unit (ISU) took a more targeted approach to the cases it blocked or made conditional on remedies in 2023 compared to its first year of review (2022), 2024 has seen those cases returning to 2022-levels, with 15 deals being blocked or conditional on remedies in 2024. Out of those, six concerned Main Market listed or AIM traded takeover targets and the majority related to Chinese or Middle Eastern acquirer structures. In terms of the remedies imposed, behavioral remedies continue to be favored by the ISU.

- Target employees and pension trustees expressed their views. In five deals, representatives of target employees exercised their right to include their opinion on the transaction in the offer documentation. In one of these five deals, the target’s pension scheme trustees also elected to include their opinion on the transaction.

- Management incentivization arrangements were rare. Only two offers required separate independent shareholder approval for special management incentivization arrangements (so-called “Rule 16 arrangements”). Both offers involved proposed management roll-over of equity into the bidco established by the PE bidder to acquire the target. This is consistent with 2023 where only one of the 57 offers included special management incentivization arrangements.

- Waiver of time pro-rating for incentive plans. In the case of executive long term incentive awards, the default treatment on a takeover is usually a reduction in the size of awards for time pro-rating. There was a trend amongst the takeovers of larger targets to waive time pro-rating, resulting in larger payouts for target executives. An exception to this trend was for awards made in the year immediately prior to the expected completion of a takeover where time pro-rating would be applied and, in some cases, the resulting lapsed portion of an award being replaced by a new award after completion to provide continued incentivization for the executives.

- Cash retention awards for target employees were prevalent. Cash retention awards for target employees during the takeover period were prevalent in 2024, reflecting the increased importance given to ensuring that a target’s business is not adversely affected by the transaction.

The analysis and commentary set out above is based on publicly available information relating to the 56 firm offer announcements (so-called “Rule 2.7 announcements”) made for Main Market listed or AIM traded targets in the period 1 January 2024 to 31 December 2024 inclusive.