Where Are We on Dodd-Frank?

The incoming Trump administration has promised to “dismantle the Dodd-Frank Act.” In previous posts, we’ve described the technical mechanisms that an incoming administration can use to undo regulation put into place by the previous administration (see How Regulatory Rollback Works and More than Just Midnight Regulations).

But how much of Dodd-Frank is there for the Trump administration to roll back? How far have regulators come in adopting Dodd-Frank rules since 2010?

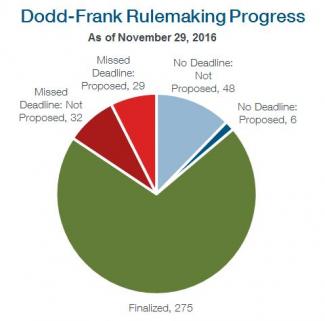

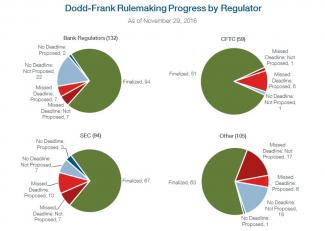

We at Davis Polk have calculated that Dodd-Frank includes a total of 390 rulemaking requirements.[1] Of these, 275 (71%) have been met by finalized rules. Other than the small number of these rules that are “midnight regulations” subject to the Congressional Review Act, formally undoing these finalized rules requires either a statutory change or a formal regulatory rulemaking process. The various regulators, working with the Trump administration, could also informally weaken these rules through guidance or by simply not enforcing the rules. An additional 35 (9%) Dodd-Frank rulemaking requirements would be met by rules that have been proposed, but not finalized. These include single counterparty credit limits, early remediation requirements, incentive-based executive compensation restrictions, swap position limits, and capital and margin requirements for security-based swap dealers. Regulators may attempt to complete some of these rules before January 20. These numbers only capture rulemaking required by Dodd-Frank and do not reflect the numerous other rules, guidance, FAQs and no-action letters that further Dodd-Frank objectives and would presumably be part of any dismantling of Dodd-Frank.