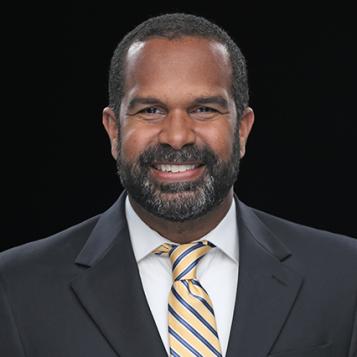

Darren Mahone

Lawyers

Advises lenders and borrowers in connection with a wide range of financing transactions.

Darren advises lenders and borrowers in connection with a wide range of financing transactions, including investment-grade and leveraged acquisition financings, asset-based financings, cross-border financings, debt restructurings, and other secured and unsecured financings.

Experience

- $6.5 billion bridge financing for United Technologies Corp.’s acquisition of Rockwell Collins, Inc.

- $9.6 billion bridge financing for Discovery Communications LLC’s acquisition of Scripps Networks Interactive, Inc.

- $4.5 billion bridge financing for Cardinal Health, Inc.’s stock and asset acquisition from Medtronic plc

- $18 billion bridge financing for Abbvie, Inc.’s acquisition of Pharmacyclics, Inc.

- $1 billion revolving credit facility for Westlake Chemical Corporation

- $2.44 billion senior secured credit facilities for XPO Logistics, Inc. in connection with its acquisition of Con-way, Inc.

- $7.123 billion senior secured credit facilities for SS&C Technologies Holdings, Inc. in connection with its acquisition of DST Systems, Inc.

- $3.225 billion exit financing credit facilities for Avaya, Inc.

Education

J.D., Fordham University School of Law

- summa cum laude

- Order of the Coif

B.A., Engineering/Economics, Yale University

Qualifications and admissions

- State of New York

- U.S. District Court, E.D. New York

- U.S. District Court, S.D. New York